The Phantom Stranger

Member

Hi guys I've been researching the best assets to invest in. A true asset is something that puts money in your pocket, and a liability, one that takes it out.

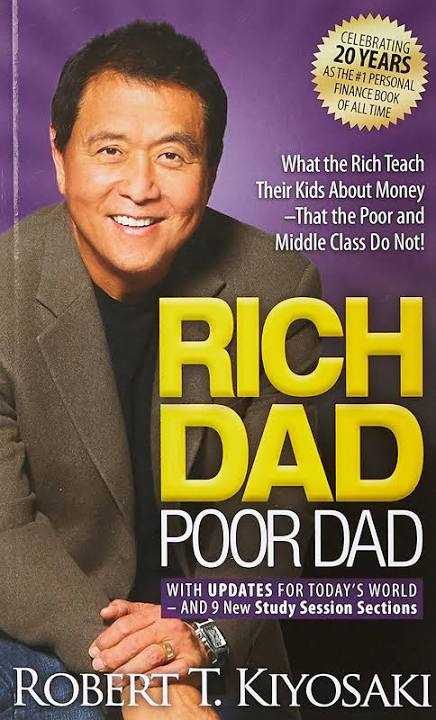

Robert Kiyosaki, world renowned entrepreneur, businessman and author of Rich Dad Poor Dad, which I highly recommend for our financial education which school never taught us and the most powerful asset to invest in is your mind and education about wealth before making it and as Satanists we need to be more educated than 90% of the public, as its actually not that hard to make large amounts of money once you understand how it actually works, has suggested that the next best asset to invest in is Silver/Gold.

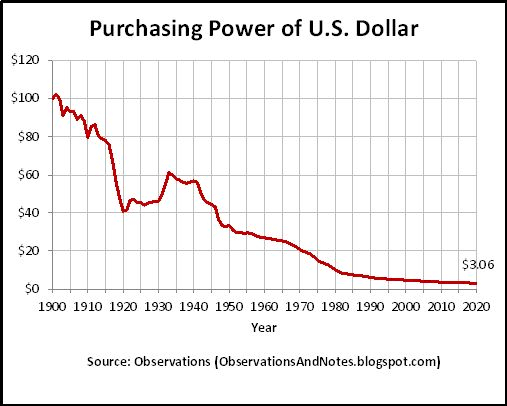

The reasoning behind this is very simple. Fiat currencies like the Dollar which was taken off the gold standard in 1971, are not really going to preserve their value due to inflation. The government prints money and they keep printing it like crazy, which leads to inflation. So in other words, saving money means your going broke slowly.

However, gold and silver are hedges against inflation and there are predictions that their value will rise well into the future. So saving gold/silver means you're saving real money which will not lose their value with time due to inflation.

As a personal example, Robert has highlighted one example of him buying a gold coin in Hong Kong for about 50$ in 1972 and today its about 2000$. He thinks the next stop is 5000$ for gold which may take another five years.

He also predicts that silver will stay at $20 for 2-4 years, then climb to $100 to $500 within this decade. He suggests that everyone should accumulate silver to protect themselves against the devaluation of fiat currencies

For more immediate predictions he says that the price of gold will rise to $3,800 and silver to $75 in 2023.

For buying options he strongly advises against ETFs and doesn't trust anything on paper. "They print it, I don't want it", he says. This is because ETFs aren't secure and that there's a facade going on, the COMEX and LBMX vaults are empty and some people believe its going to crash sooner or later. And this could potentially skyrocket the value of silver even more.

He suggests to stay away from stocks, bonds, mutual funds, ETFs as the market is manipulated. Shouldn't be surprising to us Satanists as we know many things are manipulated in the world. Real Estate has also been crashing.

One key thing he also suggests is that money is debt and that the rich don't pay taxes. This is done legally. There are legal ways to avoid taxes and also to protect your wealth from lawsuits such as corporations, these can be found in more detail in his books.

When he says money is debt, he means that he borrows money and uses that money to buy assets which generate more than enough income to cover the interest, and leftover profit which can then be reinvested again into assets, further generating more money. Making money work for you, instead of you working for money, the money is like an employee of yours generating more money.

So he suggests that debt is not necessarily a bad thing. This is what he means by making money without money. The bank is a fractional reserve system.

All in all I find his teachings to resonate well with me as he suggests that we are living in a world that has been brainwashed about money(makes sense) and that we need to go against the crowd here and question things. We need to learn more about money and get the financial education that we never got, and I think he is one author to definitely read. He has written many books and Rich Dad Poor Dad would be a great start.

Also, I recommend checking out Silver Slayer's YouTube channel on this :https://youtube.com/@SilverSlayer

Robert Kiyosaki, world renowned entrepreneur, businessman and author of Rich Dad Poor Dad, which I highly recommend for our financial education which school never taught us and the most powerful asset to invest in is your mind and education about wealth before making it and as Satanists we need to be more educated than 90% of the public, as its actually not that hard to make large amounts of money once you understand how it actually works, has suggested that the next best asset to invest in is Silver/Gold.

The reasoning behind this is very simple. Fiat currencies like the Dollar which was taken off the gold standard in 1971, are not really going to preserve their value due to inflation. The government prints money and they keep printing it like crazy, which leads to inflation. So in other words, saving money means your going broke slowly.

However, gold and silver are hedges against inflation and there are predictions that their value will rise well into the future. So saving gold/silver means you're saving real money which will not lose their value with time due to inflation.

As a personal example, Robert has highlighted one example of him buying a gold coin in Hong Kong for about 50$ in 1972 and today its about 2000$. He thinks the next stop is 5000$ for gold which may take another five years.

He also predicts that silver will stay at $20 for 2-4 years, then climb to $100 to $500 within this decade. He suggests that everyone should accumulate silver to protect themselves against the devaluation of fiat currencies

For more immediate predictions he says that the price of gold will rise to $3,800 and silver to $75 in 2023.

For buying options he strongly advises against ETFs and doesn't trust anything on paper. "They print it, I don't want it", he says. This is because ETFs aren't secure and that there's a facade going on, the COMEX and LBMX vaults are empty and some people believe its going to crash sooner or later. And this could potentially skyrocket the value of silver even more.

He suggests to stay away from stocks, bonds, mutual funds, ETFs as the market is manipulated. Shouldn't be surprising to us Satanists as we know many things are manipulated in the world. Real Estate has also been crashing.

One key thing he also suggests is that money is debt and that the rich don't pay taxes. This is done legally. There are legal ways to avoid taxes and also to protect your wealth from lawsuits such as corporations, these can be found in more detail in his books.

When he says money is debt, he means that he borrows money and uses that money to buy assets which generate more than enough income to cover the interest, and leftover profit which can then be reinvested again into assets, further generating more money. Making money work for you, instead of you working for money, the money is like an employee of yours generating more money.

So he suggests that debt is not necessarily a bad thing. This is what he means by making money without money. The bank is a fractional reserve system.

All in all I find his teachings to resonate well with me as he suggests that we are living in a world that has been brainwashed about money(makes sense) and that we need to go against the crowd here and question things. We need to learn more about money and get the financial education that we never got, and I think he is one author to definitely read. He has written many books and Rich Dad Poor Dad would be a great start.

Also, I recommend checking out Silver Slayer's YouTube channel on this :https://youtube.com/@SilverSlayer

. Or did you write this yourself?

. Or did you write this yourself?